U.S. Sales Tax setup for Business Central

- Nov 9, 2018

- 2 min read

- Tax Posting Setup : Tax Business Posting Groups and Tax Product Posting Groups - Tax Calculation is based on: Tax Groups, Tax Areas (with Tax Jurisdictions) and, Tax Details (which are the %’s attached to the Tax Jurisdictions) - Assigning Tax Codes to Customers and Items

Tax Posting Setup

Tax Posting Setup is combo of Tax Business Posting Groups and Tax Product Posting Groups.

Each combination specifies the Sales Tax Liability (G/L) account tied to that combo.

Tax Business Posting Groups and Tax Product Posting Groups are just simple lists.

Don’t need to enter a Tax% in Tax Posting Setup, because that is done with Tax Areas, Tax Groups, and Tax Details

Tax Calculation

Tax Areas

Tax Areas are simple lists of geographical areas, including a Non-Taxable entry.

Each Tax Area may contain more than one jurisdiction (e.g.: State, County, City, etc)

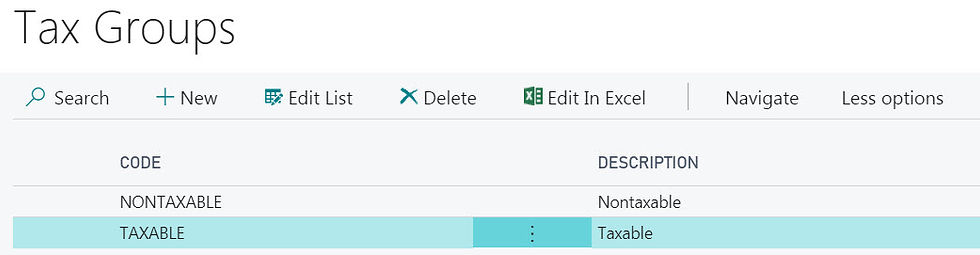

Tax Groups

Tax Groups are simple lists, such as NON-TAXABLE and TAXABLE

Tax Groups have Tax Detail line called Tax Jurisdictions. Each Tax Jurisdiction in the list contains a specific % for the legal tax, based on the Tax Jurisdiction Code.

In the example below the State of Florida applies a 6% Sales Tax. Pinellas County 1%. City of Clearwater 0%.

Tax Details

Tax Details is where the Sales Tax rates are entered for the combination of Tax Jurisdiction Code and Tax Group Code

Notice there are 2 Tax Groups, so the Tax Jurisdictions appear twice, once for each Tax Group Code.

A zero percent Tax Group Code (NON-TAXABLE) is always necessary for those sales exempt.

Assigning Tax Codes

Tax rates are decided by the Tax Area assigned to the Customer Card and the Tax Group Code on the Item Card

If the Customer is Tax Liable and is assigned a Tax Area Code which has Tax Jurisdiction Rates greater than zero; and the Item has a Tax Group Code of TAXABLE, then tax is automatically calculated for the Sales line item.

Struggling with compliance? Sales & Use Tax filing help is just a click away.